Business Checking

Business Checking Built for How You Work

Simple Checking That Supports Your Business Every Day

Running a business means managing money every day. From paying bills to receiving payments, your checking account should make those tasks easier, not harder. Business checking is designed to help you stay organized, keep cash flowing, and focus on what matters most: serving customers and growing with confidence.

Whether you are just getting started or managing steady growth, the right checking account gives you flexibility and control. You can separate business and personal finances, track expenses more clearly, and access tools that support daily operations. With online access and clear transaction records, it becomes easier to make informed decisions and plan ahead.

As your business changes, your financial needs will change too. That is why business checking should adapt as you grow. You may need more transactions, added services, or tools that help manage payments and payroll. A strong checking foundation helps your business stay efficient today while preparing for tomorrow. When your account works with you, managing money feels simpler and more predictable.

UCCU offers business services and support regardless of the checking account used for your business.

Talk to a Business Expert

Talk to a UCCU expert and find the best option for you and your business.

(801) 223-7665 | [email protected]

Available Monday – Friday 9 am – 5:30 pm

Flexible Account Options

Choose an account that matches your size, activity, and growth stage.

Convenient Everyday Cash Access

Easily manage deposits, payments, and purchases for daily business operations.

Clear Transaction Tracking

Stay organized with detailed records and clear visibility into account activity.

Checking That Grows With Your Business

No two businesses operate the same way. Some need a simple setup to get started, while others need advanced tools to manage higher volumes and more complex operations. Business checking accounts are designed to support different stages of growth, so you are not locked into one option forever.

As your business expands, you can adjust your account to match new needs. This may include higher transaction limits, added services, or support for managing employees and vendors. Having the ability to shift as your business evolves helps prevent disruptions and keeps finances running smoothly.

Pairing your checking account with other business financial tools can also support long-term success. Savings options help set aside funds for future expenses, while business services can streamline how you accept payments and manage cash flow. When your checking account is part of a complete system, it becomes more than a place to store money. It becomes a tool that supports stability, growth, and smart decision-making at every stage.

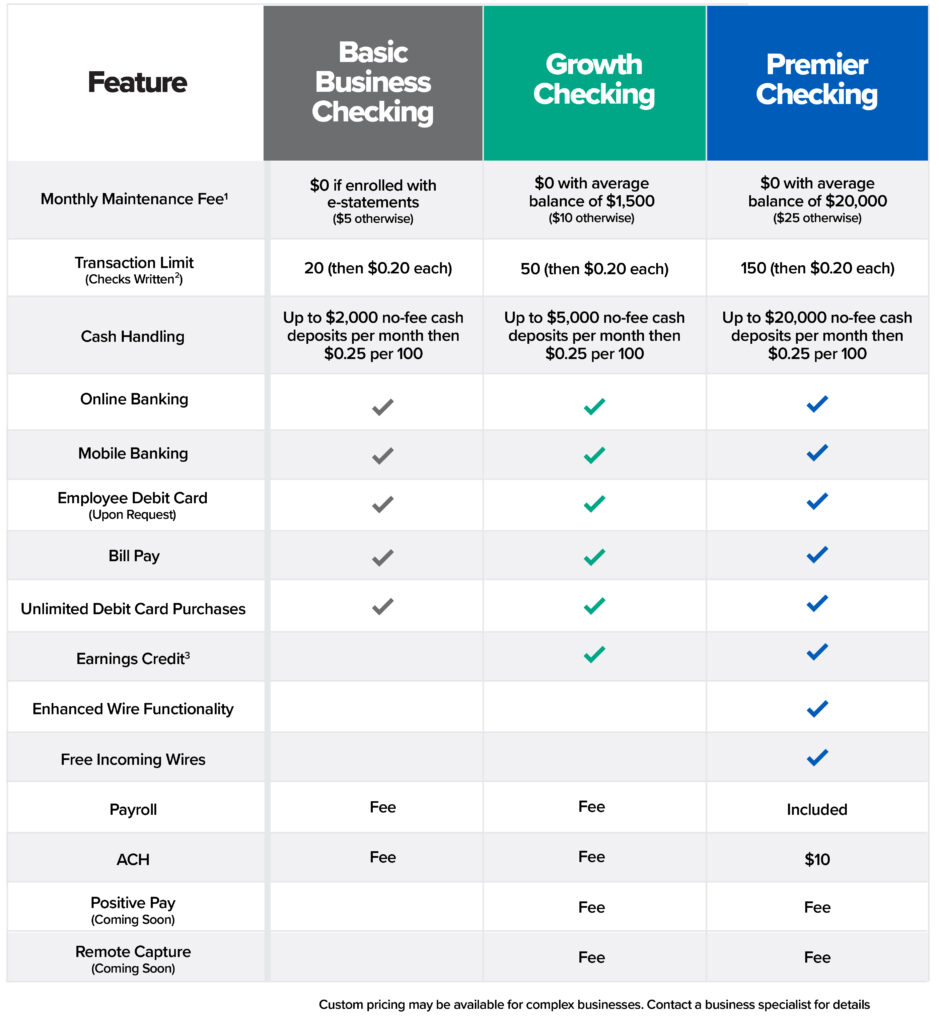

Compare Business Checking Options:

1 Monthly maintenance fee for business checking may be waived. $5.00 Basic Checking fee waived if enrolled in e-statements, $10 Growth Checking fee waived with $1,500 average balance for the applicable statement cycle. $25 Premier Checking fee waived with $20,000 average balance for the applicable statement cycle.

2 Transaction Limit is defined as checks written from the account. Any Bill Pay that is sent via check will count towards your checks written count. Bill Pay payments that are sent or converted as an electronic payment will not be added toward your written check count..

3 Charges that are offset by earnings credit may include the following and can be changed by the Credit Union at any time: per item excess written check fee, excess cash handling fee, ACH or Payroll monthly fee (does not include excess item fees), positive pay monthly service fee, and remote deposit capture monthly service fee. Earnings credit will be calculated on the average available collected balance. The earning credit rate is determined by the credit union and may change without notice. If the statement cycle earnings credit is equal to or exceeds the charges, it will result in no charge for the statement cycle. Any excess credit will not carry over to future statement cycles. If the charges in the statement cycle exceed the earnings credit for the applicable statement cycle, the amount charged to the account will be reduced by the earnings credit amount.

Frequently Asked Questions

What is a business checking account?

It is an account used to manage business income and expenses separately from personal funds.

Can I change my account as my business grows?

Yes. You can move to a different account option if your needs change.

Who should open a business checking account?

Any business owner who wants clear records and better financial organization.

Can I pair checking with other business accounts?

Yes. Many businesses pair checking with savings and other financial services.

At UCCU, every Business Checking Account includes…

We’re here to help

Call or Text

(801)-223-8188

Mon – Fri: 8:00 am – 6:00 pm

Sat: 9:00 am – 2:00 pm

Submit a Question to our Support Team

or send us a message from inside online banking.