President’s Message

Here’s what’s happening around UCCU…

Presidents Message

UCCU is Safe and Sound

In light of recent news involving certain financial institutions, I want to assure you that UCCU remains safe and sound.

UCCU maintains a strong capital base, a diverse portfolio of deposits and investments, and a solid liquidity position. Our fiscally conservative approach and prudent financial strategies over the years have positioned us to weather significant economic turmoil, ensuring that we can support your evolving needs under any circumstances.

To help you optimize your deposit insurance coverage beyond the commonly cited $250,000 limit, we offer a range of comprehensive solutions. You can click here to learn more about NCUA insurance, or by speaking with one of our expert member service representatives.

If your friends, family, or acquaintances are seeking a safe place to keep their money, please consider recommending UCCU. We stand ready to provide them with the trusted guidance, great rates, and legendary service our members have come to expect.

Our unwavering focus on operational safety, soundness, and delivering exceptional service to our members has guided us throughout our nearly 70-year history, and we know that our commitment to these values will carry us through the next century as well.

Remember, we’re always here to help. Please don’t hesitate to call, text, email, or visit a branch to speak with one of our friendly staff members.

Thank you for choosing UCCU and allowing us the privilege of serving you!

Sincerely,

Fraud Prevention

Fraud Smart: Sweetheart Scams

Protect Yourself from Romance Scams!

A Romance Scam or Sweetheart Scam is a type of scam where a fraudster creates a fake online persona to lure victims into a romantic relationship. Unfortunately, in today’s world of online dating, scams have become all too common. That’s why it’s important to understand what a Romance Scam is, and how to detect one.

A Romance Scam typically involves the following steps:

Fake online persona

The scammer creates a fake profile on a social media platform or dating app, using attractive pictures and a convincing backstory. They may also use a fake name, or steal someone else’s identity to create a more convincing persona.

Initiate contact

The scammer will initiate contact and build a relationship overtime, flattering the potential victims.

Build trust

The scammer will work to gain trust, often by sharing personal information about themselves, and asking questions to gain information.

Request money or personal information

Once the scammer has built a relationship, they will start to make requests for money or personal information. They may claim to be in financial trouble; like needing money to pay for a medical emergency, or help accessing funds that are tied up in a foreign country.

It may sound like something that can’t happen to you…

But it happens every day, because Romance Scammers are skilled at adapting their tactics to their targets’ vulnerabilities and adjusting their strategies accordingly. They may also use emotional manipulation and flattery to gain the victim’s trust and affection.

It’s essential to be aware of the signs of a Romance Scam and take steps to protect yourself from falling victim to this heartless crime.

How to Protect Yourself from a Romance Scam:

Be cautious of strangers who contact you online

If someone you don’t know approaches you online, proceed with caution, and avoid sharing personal information until you’ve confirmed the person is genuine.

Verify the identity of the person you’re speaking with

If you develop a relationship with a person that you met online, before sharing any personal information, ask for proof of identity, such as a driver’s license, passport, or other form of identification.

Take your time

Avoid rushing into a relationship, and be wary of someone who seems too good to be true.

Don’t share sensitive information

Even if you verify the person’s authenticity, never share sensitive information, such as your Social Security number, bank account details, or other financial information.

Don’t send money to someone you haven’t met in person

Scammers often request money for various reasons. If you haven’t met the person, don’t send them money. Period.

Use a secure online dating platform

Use reputable online dating sites that take proactive measures to mitigate scammers and provide security features, such as identity verification and real-time monitoring of suspicious activities.

Trust your instincts

If you have doubts about the authenticity of someone you’ve met online, trust your instincts and take a step back.

If you have fallen victim to a Romance Scam:

Stop all communication with the scammer

Block the person’s phone number and email address, and report them to the appropriate authorities.

Contact UCCU

If you have given the scammer access to your financial information, contact UCCU (or other financial institutions) to freeze your accounts and prevent further unauthorized transactions.

Report the scam

Report the scam to the Federal Trade Commission (FTC) and your local law enforcement agency. Be sure to provide as much information as possible, including the scammer’s contact information and any messages they sent you.

Protect your identity

If you provided the scammer with sensitive information, such as your social security number or driver’s license number, consider placing a fraud alert or security freeze on your credit report to prevent further identity theft.

How UCCU Helps Protects You:

At UCCU, we understand the importance of protecting our members from Romance Scams and have implemented various measures to help keep you safe, including…

Real-time Fraud Detection

By implementing real-time fraud detection technology, we can detect and prevent fraudulent transactions instantly – preventing scammers from accessing members’ funds.

Transaction Monitoring

UCCU continuously monitors member transactions for unusual activity. If suspicious activity is detected, we flag it and immediately notify the member.

Secure Payments:

By offering secure payment options, we help protect our members from not only Romance Scams, but every scam. That’s because these services ensure that funds are safeguarded and released only after the transaction has been completed.

Dealing with Inflation

Three Tips to Help Combat Inflation

In 2022, the United States witnessed a historic increase in inflation.

While Utah’s overall cost-of-living kept pace with national gains, the state has also experienced a significant surge in housing prices, making Utah one of the states hit the hardest.

The surge in inflation has caused concern among many Utahns who are worried about the rising cost of basic expenses. In a statewide poll conducted in 2021, 93% of Utahns expressed concerns about inflation, while 75% said they were worried that their wages were not keeping up with the rising rates.

As a local, not-for-profit financial institution that was founded on the ideal of “People Helping People,” UCCU is here to help.

1. Take Advantage of UCCU Mobile Banking Tools

On top of providing 24/7 banking, UCCU’s award-winning Mobile Banking is packed with tools that are designed to help you better manage your finances, and combat the challenges of inflation, including…

- Real-Time Alerts: so you can stay on top of your spending and prevent overdraft fees.

- Advanced Budgeting Tools: to help you set and track your progress towards your financial goals.

- 360-View Financial Aggregation: that makes it easy to see all of your assets and liabilities, all in one place.

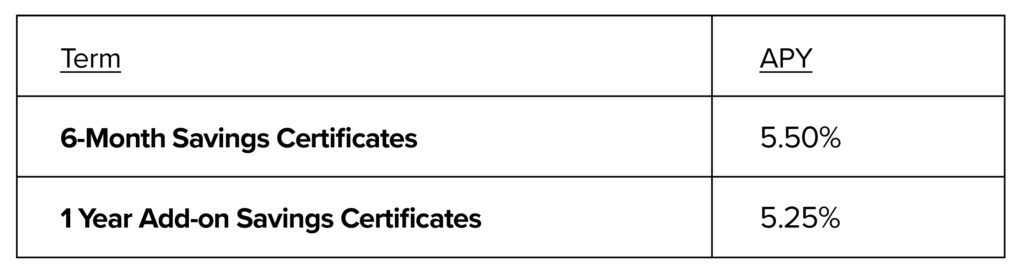

2. Get a UCCU Savings Certificate

A Savings Certificate is a smart way to use inflation to your advantage. Here’s why…

While Savings Accounts come with unlimited deposits and withdrawals, a Savings Certificate is designed for you to make one deposit, and then let your money grow – and grow and GROW – with a fixed rate of return that’s much HIGHER than a standard Savings Account.

Simply put, with a Savings Certificate, your savings work harder and earn more.

So if you have savings just sitting in a standard account, put those funds to work for you with a Savings Certificate from UCCU.

3. Meet with a UCCU Expert

UCCU has been helping families and individuals improve their financial lives for over 65 years. Simply put, we’re not just a credit union. UCCU is your financial advocate.

That’s why UCCU has friendly experts at work in every branch, ready to review your unique situation and provide you with the best tools and resources for combating inflation and achieving your financial goals. We invite you to see for yourself. Simply give UCCU a call at (801) 223-8188, or stop by any branch location for assistance.

4321 Cash Back Card

Get More Cash Back on Your Everyday Purchases

Using a “Cash Back” credit card is a smart way to get rewarded for your everyday spending. But not all credit cards are created equal. In fact, some cards come with rates and fees that can vary wildly, and cost you big. That’s why UCCU created the 4-3-2-1 Cash Back VISA Credit Card.

This is a card specifically designed to make getting your cash simple and maximizing the reward you’ll get back on the spending you’re already doing. Get rewarded automatically with…

· 4% Cash Back on Travel

· 3% Cash Back on Gas

· 2% Cash Back on Groceries – including Costco® and Sam’s Club®!

· 1% Cash Back on Everything Else.

There are no rate hikes, no annual fees, and no balance transfer fees. The 4-3-2-1 Cash Back VISA simply comes with a low variable rate that stays low – so the cash you get back goes back into your pocket.

Click here to apply now!

Click to view Credit Card Rate & Fee Disclosure, Visa Cardholder & Protection Agreement, or the 4-3-2-1 Cash Back Card details.

Supercharge your Savings

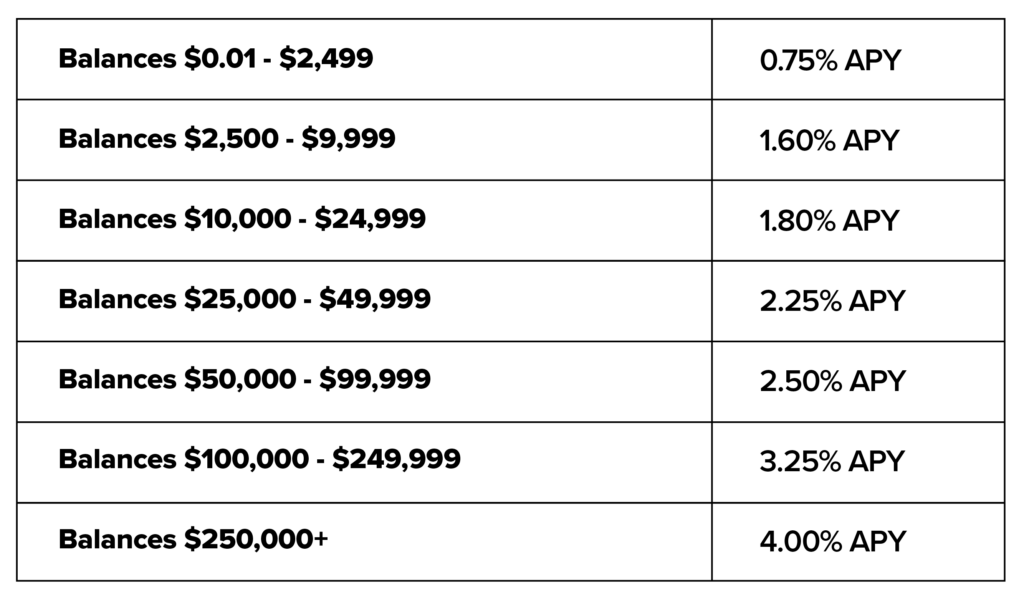

Is your savings earning you as much as it can? Now is the perfect time to supercharge your savings at UCCU. Because right now, UCCU is offering savings options with yields as high as 5.50% APY!

We also make it easy to transfer funds from other financial institutions. Simply select a high-yield savings option or a combination of options to supercharge your savings!

Savings Certificates

Click to view all saving certificate terms and yields

Money Market Offering

Visit uccu.com/Supercharge to get started.

You can also give UCCU a call at (801) 223-8188 or stop by any branch location, where a friendly Financial Expert would be happy to help you determine which high-yield savings option is right for you.

*APY=Annual Percentage Yield. Limited time offers. Yields, terms, and conditions are subject to change at any time and without notice. Federally insured by NCUA. Click here for truth-in-savings for savings accounts. Click here for truth-in-savings for savings certificate accounts.

UCCU Assist

Delivering Assists to families and individuals across Utah

Every now and then, we could all use an Assist – that little help or assistance in our lives that can make all the difference in the world.

And at UCCU, we’re on a mission to deliver Assists to families and individuals in communities across Utah…

- Previous

- Phishing Scam