Call or Text

(801) 223-8188

Mon – Fri: 8:00 am – 6:00 pm

Sat: 9:00 am – 2:00 pm

Submit a Question to our Support Team

or send us a message from inside online banking.

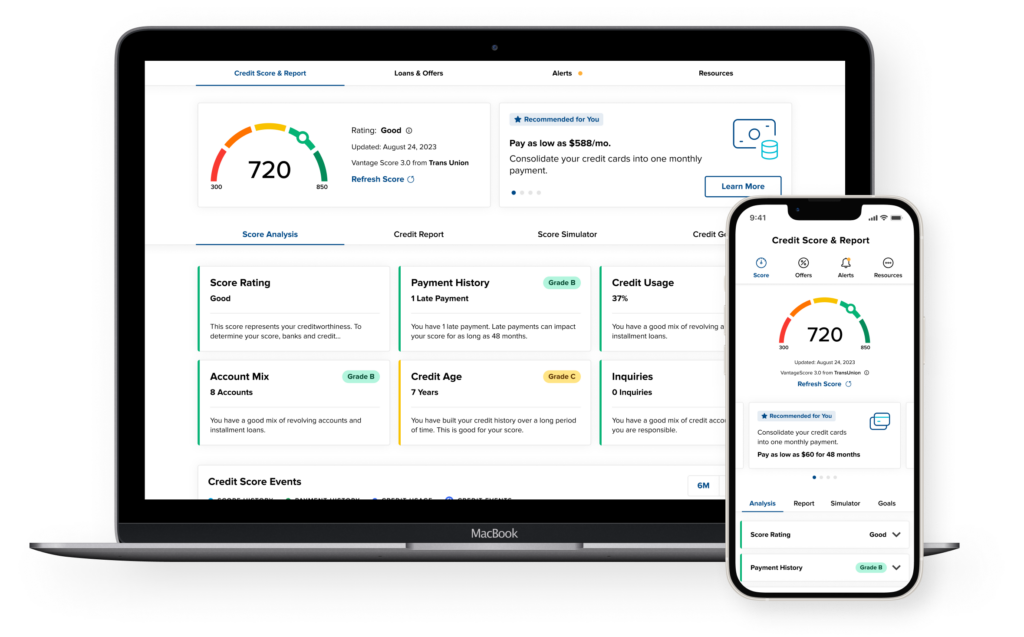

An array of tools made to monitor and increase your credit score

Want to qualify for lower interest rates on your loans? Start by increasing your credit score with the UCCU Credit Score Toolbox available to all UCCU members. Get access to full credit checks without hurting your credit score and run personal credit simulations to determine how upcoming financial decisions can impact your credit.

Apply for new loans using Elevated Checking Loan Discounts can also help grow your credit score.

Want to raise your credit, but don’t know where to start? Use the Credit Score Toolbox found right inside your UCCU online banking. View your credit score, run credit simulations, and find other helpful tools to boost your credit.

(801) 223-8188 | Branch Locations

Available M–F 8am–6pm, and Sat. 9am–2pm*.

*Saturday hours vary per Branch Location

Powered by SavvyMoney. (Registration/activation required.)

No. Credit Score can be accessed by any UCCU member absolutely free. Login to your UCCU Digital Banking. Select “Services” then “Credit Score Toolbox or simply scroll to the bottom of the home page and select “Show My Score” to get started.

If you are not a UCCU member, you can open an account and gain full access to Credit Score.

Yes. Along with Credit Simulator, Financial Health Score, and Credit Score Goals, there are many other Credit Building tools offered by Savvy Money including credit market trends, advanced analytics, and additional reports on your personal credit score.

UCCU also offers other credit tools such as Credit Builder, Loan Discounts, and Checking Protection to help you on your credit building financial journey.

Contact a UCCU representative at any of our local Branch Locations. You can also call or text us at (801) 223-8188 for any credit building questions. UCCU Representatives will help assess your personal situation to best help you increase your credit score.

Your credit score, ranging from 300 to 850, is pivotal when you apply for credit, including auto loans, mortgages, or credit cards. At UCCU, we understand the importance of maintaining a good credit score to secure favorable terms on loans and credit cards. It’s determined by factors such as payment history, credit utilization rate, length of credit history, and types of loans in your credit reports from credit bureaus. By consistently paying your bills on time and managing your credit responsibly, you can achieve a higher credit score, making you more attractive to credit card issuers and lenders.

Understanding how your credit score is calculated, particularly by FICO scores, is essential for managing your financial well-being. FICO scores range from 300 to 850 and consider various factors, including payment history, credit utilization rate, length of credit history, types of loans, and credit limit utilization. By analyzing the information in your credit reports from credit bureaus, FICO scores evaluate your creditworthiness and help lenders assess the risk of extending credit to you. By maintaining a low credit utilization rate and demonstrating responsible credit management habits, you can positively impact your FICO score and improve your chances of securing credit at favorable terms.

Improving your credit score is achievable by implementing sound financial practices and understanding the factors that influence your FICO score. Start by paying your bills on time and keeping your credit utilization rate low relative to your credit limit. Additionally, consider the length of your credit history and the types of loans you have, as these factors contribute to your overall creditworthiness. By regularly monitoring your credit reports from credit bureaus and disputing any inaccuracies, you can ensure that your credit profile reflects accurate information. At UCCU, we’re here to support you on your journey to achieving and maintaining a higher credit score, empowering you to achieve your financial goals.

Cell Phone Protection, Roadside Assistance, Telehealth, and more!

Explore ContentDark Web Monitoring, Identity Protection, ID Theft Resolution, and more!

Explore Content(801) 223-8188

Mon – Fri: 8:00 am – 6:00 pm

Sat: 9:00 am – 2:00 pm

or send us a message from inside online banking.

Notifications