Call or Text

(801) 223-8188

Mon – Fri: 8:00 am – 6:00 pm

Sat: 9:00 am – 2:00 pm

Submit a Question to our Support Team

or send us a message from inside online banking.

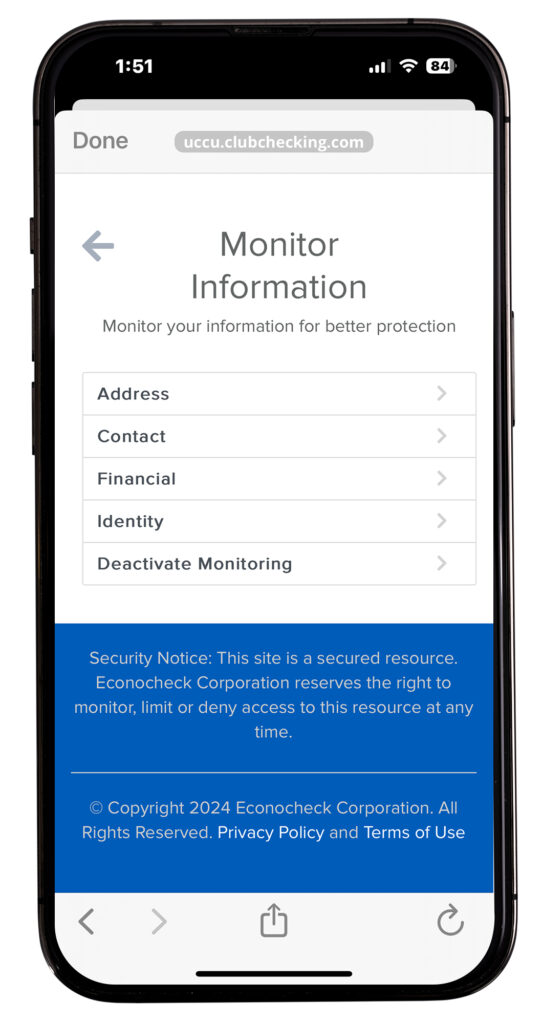

Dark Web Monitoring, also known as cyber monitoring, is an identity theft prevention product to monitor your personal information on the dark web and receive alerts when your registered information is exposed online. Registered information can include Social Security Numbers, emails, phone numbers, credit/debit cards, usernames, driver’s license/national ID, medical ID, etc. Alerts and notifications, including breach descriptions and resolution recommendations, can be found in your app and email.

Note: Only registered information that you manually enter will be monitored.

Safeguard your private information from all parts of the web. Sign up for Elevated Checking and then activate your 24/7 security with Dark Web Monitoring.

(801) 223-8188 | Branch Locations

Available M–F 8am–6pm, and Sat. 9am–2pm*.

*Saturday hours vary per Branch Location

Activating a dark web monitoring solution is also essential for protecting your sensitive information from the perils of the dark web. The dark web is a hidden segment of the internet, accessible only through special software, where anonymity allows for the trade and misuse of stolen data. By using a dark web monitoring service, you’re alerted if your personal details—such as bank account numbers, email addresses, or Social Security numbers—appear on dark web sites. This early detection is crucial for preventing identity theft and allows you to take immediate action to secure your information before it can be exploited in a data breach.

Receiving an alert from a dark web monitoring service means that your sensitive data has potentially been compromised and surfaced on the dark web. Upon receiving such an alert, it’s important to first verify the accuracy of the information. If the data leak is confirmed, you should then promptly follow the recommended security measures provided in the alert. This generally includes changing passwords, securing potentially affected accounts with additional security tools, and contacting financial institutions to preempt fraudulent transactions. Continuous monitoring and vigilance are crucial following an alert to mitigate further risks.

To limit potential and future security breaches, proactive and robust security measures must be employed. Always safeguard your sensitive information by refraining from sharing it unnecessarily, especially on public platforms. Utilize security tools such as strong, unique passwords for each account, and engage features like two-factor authentication. Keep your software up-to-date to defend against vulnerabilities, and educate yourself on recognizing phishing attempts and suspicious activities. Utilizing a dark web monitoring tool can also alert you to any unexpected appearances of your personal data on dark web sites, enabling you to act swiftly to secure your data.

The best way to deal with security breaches is to catch them early and also prevent them. For example, never publicly post your social security number or other identification documents. For more helpful tips and up-to-date information about current frauds and scams, you can also visit our Fraud Protection resource page.

With Elevated Checking, customers gain access to comprehensive security features tailored to protect their identity and sensitive data.

Cell Phone Protection, Roadside Assistance, Telehealth, and more!

Explore ContentDark Web Monitoring, Identity Protection, ID Theft Resolution, and more!

Explore Content(801) 223-8188

Mon – Fri: 8:00 am – 6:00 pm

Sat: 9:00 am – 2:00 pm

or send us a message from inside online banking.

1Dark Web Monitoring: Monitor your personal information on the dark web and receive alerts when your personal information is exposed online with our Dark Web Monitoring identity theft prevention product, also known as cyber monitoring. Available via mobile or web only. (Registration/activation required.)

Benefits are subject to change at any time and without notice. Some benefits require registration and activation. Terms and conditions apply. Click here for Elevated Checking details and guide to benefits for coverage and exclusions.

Notifications