Find answers to your questions about UCCU’s Online Banking Experience.

Account Alerts and Notifications

Created to simplify your life and increase your peace of mind.

Staying Informed

- Account alerts are a free and easy way to stay informed of the activity on your account that’s most important to you.

- Alerts are customizable, so you can use them for whatever you need, from monitoring your spending (or your child’s spending!), to being notified when you get paid.

- You can choose to receive alerts via push notification, email, text, or phone call.

- Enable push notifications to receive security alerts immediately.

It’s easy to set up Alerts and Notifications

- Download the UCCU mobile banking app or login online.

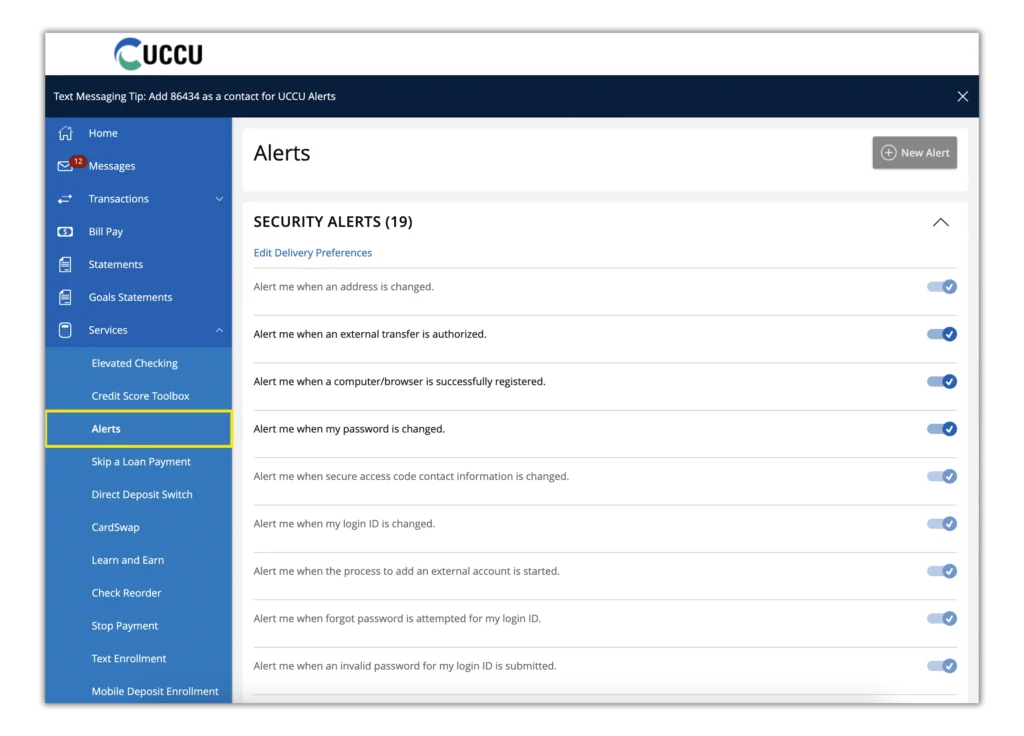

- Select “Alerts” from the Services Menu.

- Then create new alerts or modify your existing alerts.

Download the UCCU Mobile App

Make it easy, automate your loan payment today!

(801) 223-8188 | Branch Locations

Available M–F 8am–6pm, and Sat. 9am–2pm*.

*Saturday hours vary per Branch Location

Alerts and Notifications Include

Account Alerts

Use Account Alerts to set up alert triggers regarding account balances, like receiving a text alert if your checking account balance falls below a selected amount.

Transaction Alerts

Customizable alerts that monitor your account history for you. For example, you can choose to receive alerts when transactions occur above, below, or at a certain value or to be notified when transactions contain a specific word.

Online Banking Transaction Alerts

A great security tool to monitor activity and transactions performed within Online or Mobile Banking.

Security Alerts

A great way to be notified of suspicious activity in online banking such as a failed password attempt, a password change, a new external account, or contact info change.

Statements & Tax Documents

All the statements and documents you need, organized in one place.

UCCU Online Banking FAQs

We’re here to help

Call or Text

(801)-223-8188

Mon – Fri: 8:00 am – 6:00 pm

Sat: 9:00 am – 2:00 pm

Submit a Question to our Support Team

or send us a message from inside online banking.