Call or Text

(801) 223-8188

Mon – Fri: 8:00 am – 6:00 pm

Sat: 9:00 am – 2:00 pm

Submit a Question to our Support Team

or send us a message from inside online banking.

A Home Equity Line of Credit is an open-ended loan that’s issued to a homeowner based on the equity they have in their home. Popular uses include:

A seasoned home loan professional, ready to act as your home equity advocate.

801-223-7650 | equity@uccu.com

or send us a secure message from within online & mobile banking.

Available M–F 8am–6pm, and Sat. 9am–2pm

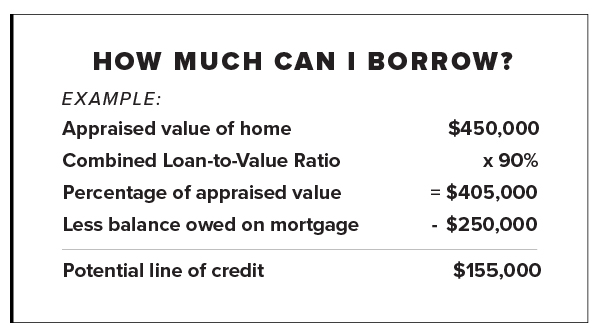

Example is for illustrative purposes only. Apply to get accurate line of credit amount.

Lowest payment possible for optimal cash flow.

Interest-only Payment Option

6-month Introductory Fixed Rate

10-Year Draw Period

Fixed rate up to ten years for optimal peace of mind.

Principal and Interest Payment

Fixed up to 10 years

5-Year Draw Period

Yes! Listed below is some more information regarding Standard Home Equity Line of Credit

Yes! Listed below is some more information regarding Initial Home Equity Line of Credit

There are many questions you can ask regarding a Home Equity Line of Credit. UCCU is here to help. Talk to a HELOC expert to see what options would be best for your personal situation. You can also check out our 6 Questions to Ask Before Getting a HELOC article for more in-depth details.

(801) 223-8188

Mon – Fri: 8:00 am – 6:00 pm

Sat: 9:00 am – 2:00 pm

or send us a message from inside online banking.

*Financing is subject to UCCU membership and underwriting criteria. Not every applicant will qualify. Property insurance is required. Variable rates based on the Prime Rate as published in the Wall Street Journal on the 15th day of the month prior.

Additional Draw period extensions may be approved: Pending underwriting review.

No closing costs and no fee options available: Conditions apply. Appraisal fee will apply if loan amount is greater than $400,000 or if required by the underwriter. If the loan is paid off within 24 months of funding date, reimbursement of all third party fees required. These may include but not limited to title, automated valuation, and insurance fees.

Rate inflation protection: UCCU protects you against drastic rate fluctuations in the market by not allowing your rate to increase more than 0.25% per quarter (3 months) and no more than 6.00% above the non-discounted rate over the life of the loan. The maximum APR that can apply is 18.00% or maximum permitted by law, whichever is less. However, under no circumstances will your APR go below the minimum 4.99% at any time during the term of the plan except when an introductory rate applies. The APR can change monthly on the first day of the month. Minimum home equity line of credit: $10,000.

Up to 90% combined loan-to-value (CLTV): the maximum CLTV up to 90% varies upon borrower’s credit score, requested loan amount, and balances of mortgage (or any superior liens on the property). Rates, terms, and programs are subject to change and without notice. Equal housing lender. NMLS # 407653. Federally insured by NCUA.

*APR = Annual percentage rate. Financing is subject to UCCU membership and underwriting criteria, not every applicant will qualify. Rates as low as 4.99% introductory fixed rate for 6 months, 7.49% variable APR (Prime – 0.01%). For loans greater than 80% LTV (loan-to-value) the variable APR is 8.74% (Prime – 1.24%). Property insurance is required. Interest rate will not vary above 18.00% or below 4.99%. Variable rates based on the Prime Rate as published in the Wall Street Journal on the 15th day of the month prior. Limited time offer. Appraisal, title, and insurance fee reimbursement required if paid off and closed within 24 months of funding date. Equal housing lender. NMLS # 407653. Federally insured by NCUA.

*APR = Annual percentage rate. Financing is subject to UCCU membership and underwriting criteria, not every applicant will qualify. Rates as low as 6.74% variable APR (Prime – 0.76%). For loans greater than 80% LTV (loan-to-value) the variable APR is 7.24% (Prime – 0.26%). Property insurance is required. Interest rate will not vary above 18.00% or below 4.99%. Variable rates based on the Prime Rate as published in the Wall Street Journal on the 15th day of the month prior. Limited time offer. Appraisal, title, and insurance fee reimbursement required if paid off and closed within 24 months of funding date. Equal housing lender. NMLS # 407653. Federally insured by NCUA.

Be advised UCCU does not provide and is not responsible for the product, service, overall website content, security, or privacy policies on any external third-party sites. The UCCU privacy and security policies do not apply to linked sites.

ContinueNotifications